About the project

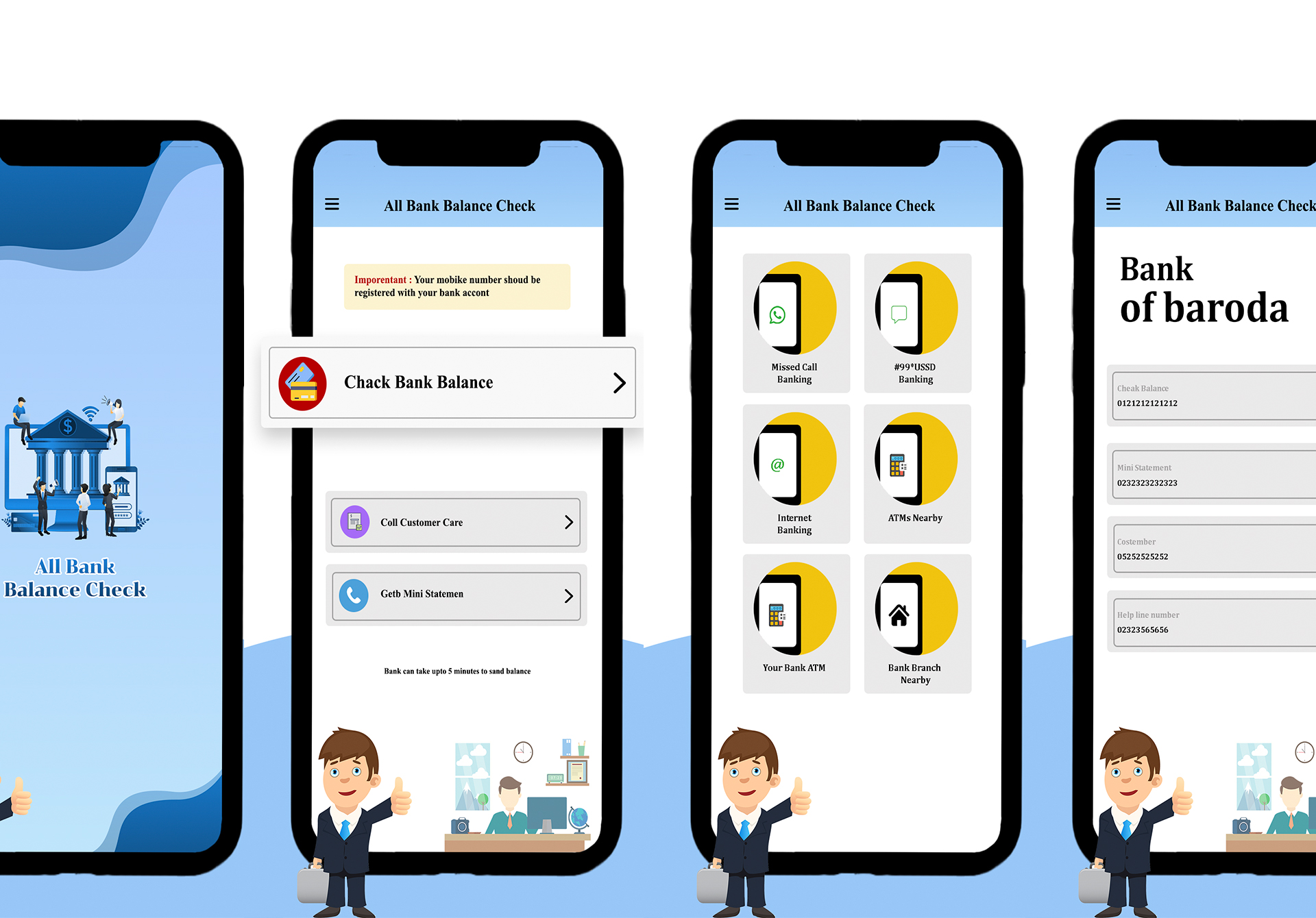

The "All Bank Balance Check" project aims to develop a system or application enabling users to

conveniently check their account balances across multiple banks in one place. This endeavor

involves researching and integrating APIs provided by various banks for accessing balance

information securely. The system's architecture must prioritize security, scalability, and

usability while implementing robust user authentication mechanisms and ensuring compliance with

relevant regulations. Features include user-friendly account linking, balance retrieval, and

displaying information through a well-designed interface. Security measures encompass

encryption, compliance with banking regulations, and adherence to data protection standards.

Thorough testing, deployment to a secure hosting environment, and ongoing maintenance are

essential to deliver a reliable, secure, and compliant solution that prioritizes user privacy

and data security throughout the development lifecycle.

The "All Bank Balance Check" project represents a comprehensive endeavor aimed at simplifying

the process of accessing and managing bank account balances across various financial

institutions. Through meticulous research and integration of APIs or alternative data retrieval

methods, the project seeks to aggregate account balance information securely within a unified

platform. Emphasizing user authentication and stringent security measures, including encryption

and compliance with regulatory frameworks, the system ensures the confidentiality and integrity

of sensitive financial data. Furthermore, a user-friendly interface facilitates seamless account

linking, balance retrieval, and intuitive display of information, enhancing user experience and

accessibility. Rigorous testing, deployment in a secure hosting environment, and ongoing

maintenance underscore the commitment to delivering a reliable, scalable, and compliant solution

that prioritizes user privacy and data protection, thus empowering individuals with greater

control and insight into their financial assets across multiple banking institutions.

Technologies

: TypeScript, React with Redux, Nest.js, Kotlin.

Services

: Code Audit,

Web App Development

,

Native iOS App

Development

,

Native Android App Development

, Maintenance.

Challenge

The primary challenge in the "All Bank Balance Check" project lies in integrating with diverse banking

systems to retrieve account balance information reliably and securely. Each bank may have its own unique

API or data access method, often with varying levels of documentation, authentication requirements, and

data formats. This heterogeneity poses significant technical hurdles in developing a unified solution

that can seamlessly fetch balance data from multiple institutions.

API Standardization:

Despite the lack of standardized APIs across banks, efforts can be made to standardize data exchange

protocols and authentication mechanisms where possible. This may involve developing adapters or wrappers

to normalize API interactions across different banking systems.

Data Format Harmonization:

Banking systems may use different data formats and structures to represent account balances and related

information. Developing parsers and converters to harmonize disparate data formats into a consistent

format within the application is essential for seamless data processing.

Error Handling and Recovery:

Robust error handling mechanisms must be implemented to handle discrepancies in API responses, network

errors, and downtime of banking systems. Implementing retry strategies, caching mechanisms, and fallback

mechanisms can enhance system resilience and reliability.

Scalability and Performance:

As the number of integrated banks and users increases, the system must be capable of scaling efficiently

to handle a growing volume of requests while maintaining optimal performance. Load testing and

optimization of backend services are necessary to ensure scalability.

Solution

To address the challenge of integrating with diverse banking systems for the "All Bank Balance Check"

project, the proposed solution is to develop a Unified Banking API Gateway. This gateway acts as an

intermediary layer between the application and various banking APIs, providing a standardized interface

for retrieving account balance information from multiple institutions.

Monitoring and Maintenance:

Comprehensive monitoring tools are integrated to track API usage, performance metrics, and system

health. Proactive maintenance and regular updates ensure the gateway remains compatible with evolving

banking APIs and technological advancements.

Compliance and Regulatory Integration:

The solution incorporates compliance checks to ensure adherence to banking regulations such as GDPR, PCI

DSS, and PSD2. It facilitates regulatory compliance by enforcing data privacy and security measures

mandated by relevant authorities.

Authentication and Security:

The gateway manages authentication with banking APIs using industry-standard protocols such as OAuth

2.0. It enforces secure communication through encryption and compliance with security best practices to

safeguard sensitive financial data.

Financial Goal Setting:

Enable users to set financial goals within the application, such as saving for a vacation or paying off

debt. Users can track their progress towards these goals and receive recommendations on how to optimize

their finances to achieve them faster.

Financial Goal Setting:

Implementing MFA adds an extra layer of security by requiring users to provide additional authentication

factors such as a one-time password (OTP) or biometric verification before accessing their account

balances. This strengthens the security of the application and protects against unauthorized access.